This article is brought to you by Datawrapper, a data visualization tool for creating charts, maps, and tables. Learn more.

How to save the world while making people better off

Carbon dividend, explained

Hi, it’s Lisa! I’m responsible for design & blogging at Datawrapper. Climate change is a big topic these days, but most (data visualizations) show the causes and potential consequences, not possible solutions. I wanted to change that, so I’ve tried to understand the idea of the Carbon Fee & Dividend better. It’s basically a carbon tax that shares its revenue equally among the population. I’ll explain the concept here with a few of our tables:

Carbon emissions are bad for the climate, so let’s get rid of them. But how? One idea is the carbon tax: It’s a “price” for each tonne of CO2 a country consumes. Let’s assume we start taxing each tonne CO2 with €50. When you go to the shop tomorrow and buy stuff that accounts for 1 tonne of CO2 (e.g. 440 liters of gasoline), you’ll pay €50 more for it at the register. The goal is that this makes you buy less in the first place.

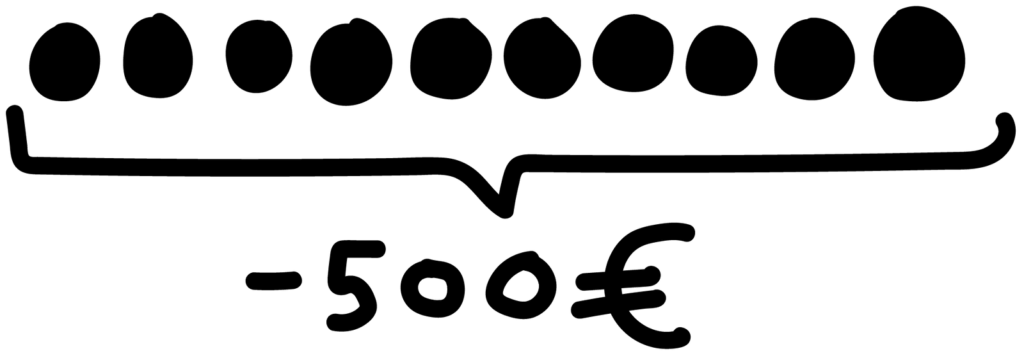

Each German accounts on average for 9.7 tonnes of CO2 per year. (Let’s round this up to 10 tonnes.) If you buy products that cause exactly these 10 tonnes CO2, you’ll pay €500 per year more thanks to the carbon tax.

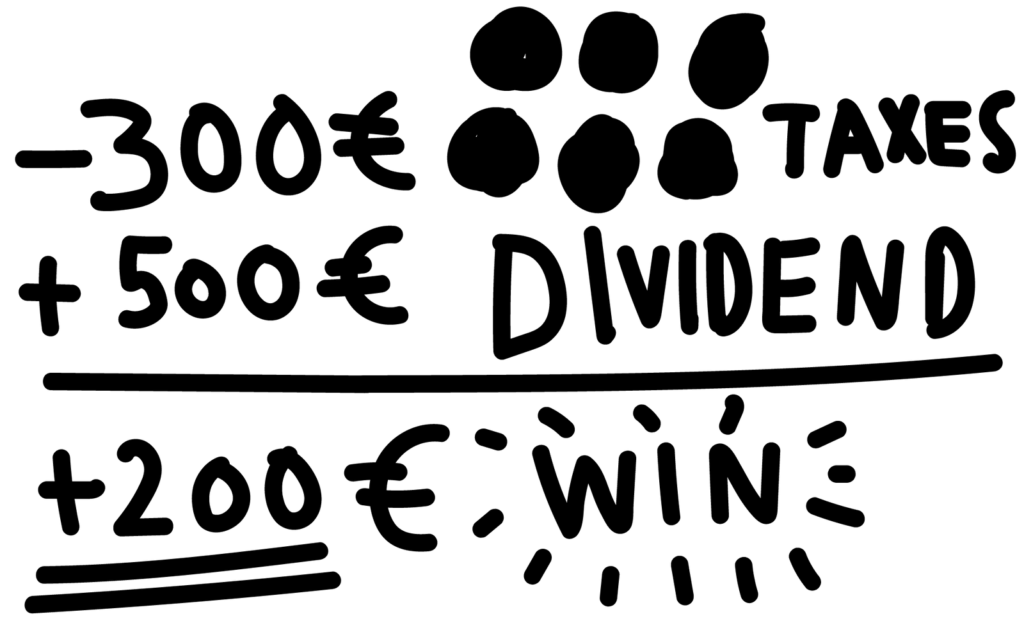

That’s a lot. That’s especially a lot for people with less income. And that’s why smart people had the idea that the government doesn’t keep the tax revenues, but that it transfers the €500 back to you. It’s called a “carbon dividend” (a dividend is money paid to shareholders out of profits). Let’s do the math again for the whole country:

Equalizing society

The carbon tax in combination with the dividend sets an incentive to look for low-carbon alternatives (public transport instead of the car).

But the carbon dividend is also a good equalizer. If your income is low, you spend less money in general, and therefore less money on carbon-intense products (there’s a reason why developing countries have low CO2 emissions per capita). When you account for 6 tonnes of CO2 while everyone else accounts for 10, you’ll spend just €300 more on products in a year…but the government will still give you your dividend of €500. A win of €200!

And that €200 can make a difference. €200 feels like a 1% raise to you when you earn €20k, but it’s only a 0.2% raise when you earn five times as much.

So the carbon dividend favors the ones with less income, in absolute and relative terms. “According to the US Treasury Department, the bottom 70 percent of Americans would receive more in dividends than they would pay in increased energy prices,” self-called policy entrepreneur Ted Halstead explains in his TED talk about the carbon dividend. “That means 223 million Americans would win economically from solving climate change.”[1]

That’s the idea: Rich people pay the carbon tax to buy rich-people-stuff, and the tax revenue flows to low-income earners.

A tax that wants to get rid of itself

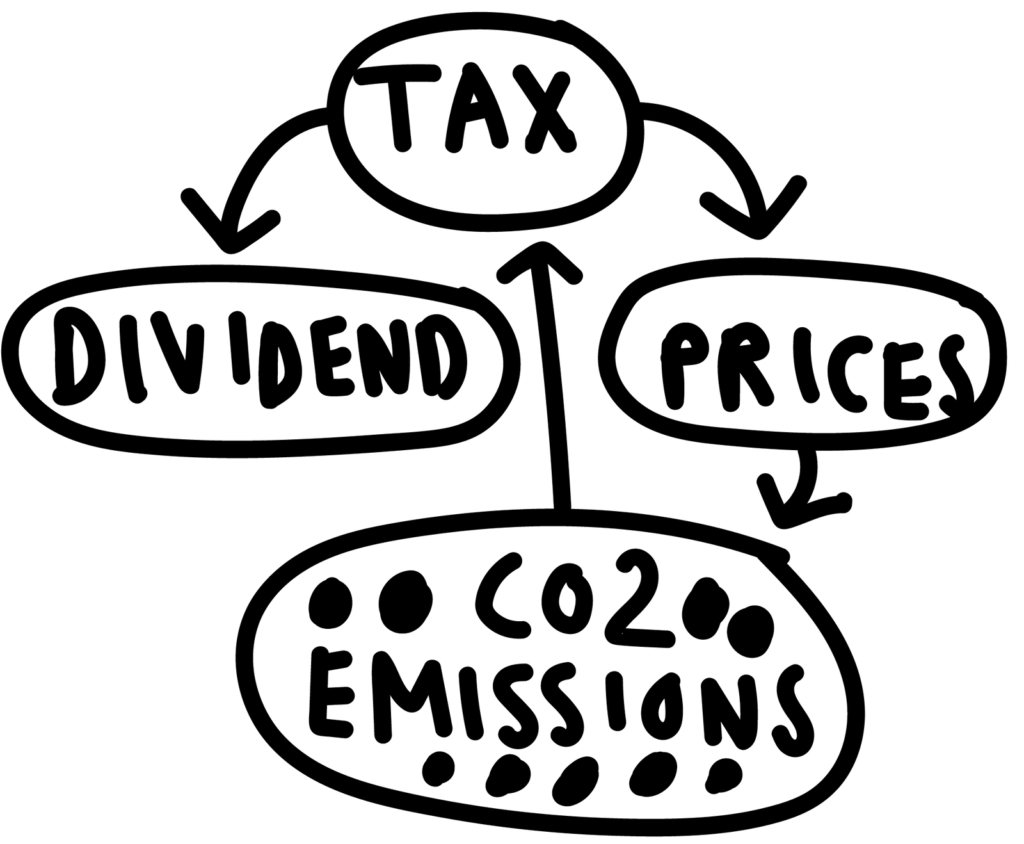

Carbon dividends are systems that influence themselves: How much dividend the government transfers to you, depends on how much carbon taxes it collects. And that depends on how much money we all spend on CO2-intense products. And that depends on how much these products cost. And they cost more because of the carbon tax.

So the goal of the carbon tax is to lower CO2 emissions, and therefore to lower the carbon tax revenue, and therefore to lower the dividend.

And there’s so much potential to lower these emissions. People in the UK emit 3.9 tonnes CO2 per capita per year less than Germans do. That’s not because the British live more environmentally conscious than Germans, but because of a different electricity mix.

And Germans, Americans, Brits – almost all countries decreased their CO2 emissions already, through innovations and regulations:

There’s lots this article doesn’t talk about: Like the question if we should tax CO2 emissions or CO2 equivalents (and what they are in the first place). Or what impact yearly increasing carbon taxes have on the dividends. Or how the process of taxing works exactly. Or how we’d deal with imports and exports. If you’re interested in learning more, I can recommend Ted Halstead’s TED talk and the FAQs on the website of the Carbon Tax Center. See you next week!

The source for this statement is the last page of the working paper “Methodology for Analyzing a Carbon Tax” (PDF) by the Office of Tax Analysis, published in 2017. However, a paper by the Citizens’ Climate Lobby – also advocating for the carbon dividend – assumes that 53% of US families and 58% of individuals would gain, not 70%.↩︎

Comments